In our fourth ESG Newsletter, we discuss how corporate governance has been becoming an integral part of mandatory ESG reporting. We also explain in detail what corporate governance means, why it is important for each company, and what information and how should be disclosed in reports.

The legal acts mentioned in this Newsletter were described in detail in the second issue of our ESG Newsletter (you can find it HERE), and if you are not sure if you are obliged to report, we encourage you to read our third ESG Newsletter (available HERE).

![]()

Corporate Governance: why is it so important?

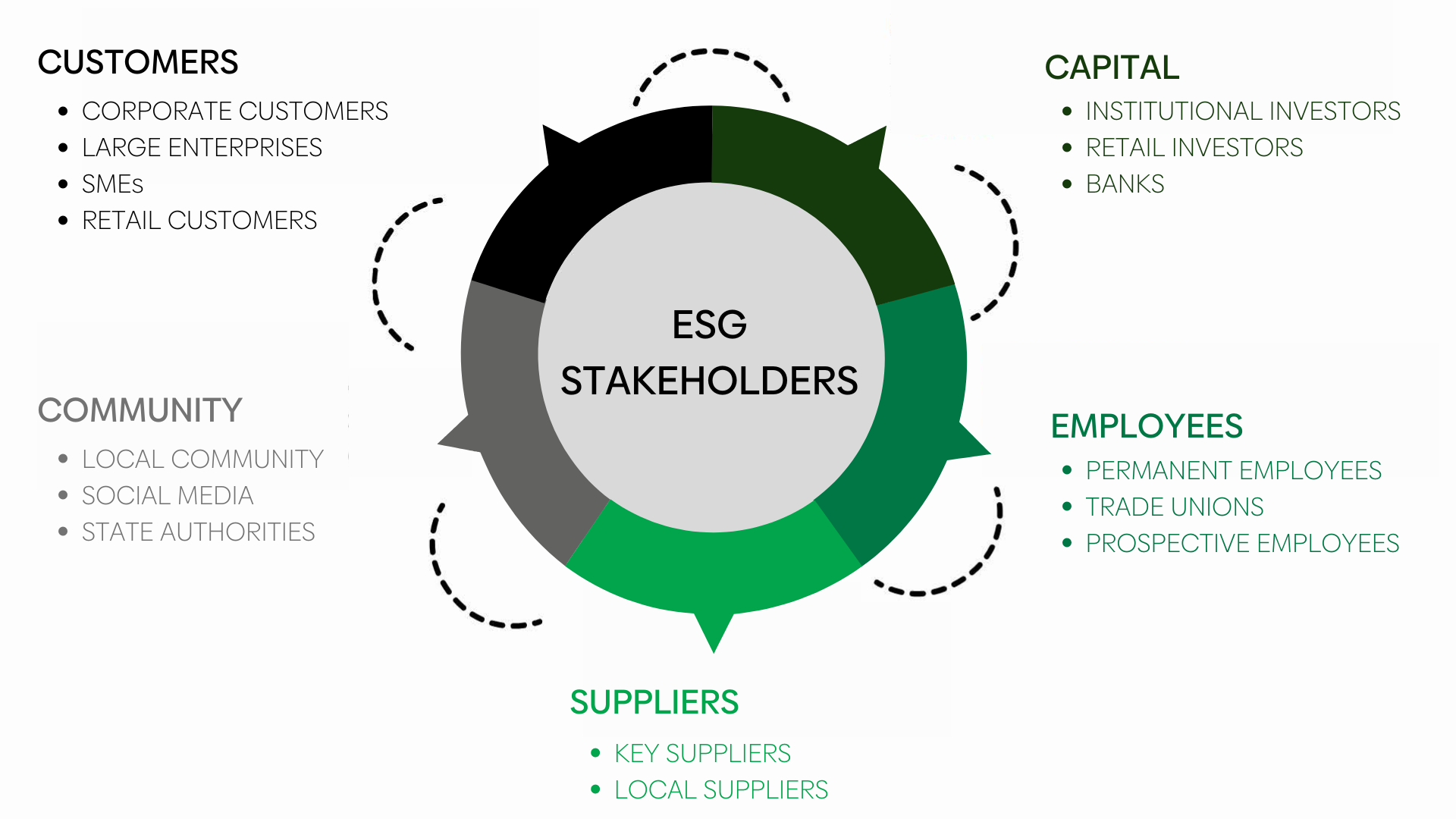

Corporate governance is a set of rules, practices and processes used to manage and control a company. The idea behind this concept is that a company does not generate any value for itself, but on various levels benefits individuals and other legal entities that are somehow related – directly or indirectly – to the company. These persons and entities are called stakeholders as they are interested in maximising the benefits arising from the company’s existence.

Usually, two main groups of stakeholders are distinguished in the context of corporate governance: owners and other stakeholders.

![]()

Owners are primarily shareholders, i.e. entities that have the most control over the company and benefit from it, e.g. by receiving dividends.

Other stakeholders are employees, management board, lenders, suppliers, customers, local community and others. These persons and entities are also important in the context of corporate governance because a company affects their lives. Employees want to receive their salaries on time, lenders – have their loans repaid, suppliers – maintain their business relationships, while customers are interested in company products, and local community – in clean environment around a factory.

Corporate governance is intended to create such conditions in a company that ensure that each stakeholder is treated fairly by the other stakeholders, especially the owners.

The difficulty in formulating uniform corporate governance principles stems from the fact that its understanding differs significantly in many parts of the world. There is no single universal concept of corporate governance, as each country, in shaping its own governance has done so in its own way, determined by its economic and social history and its own legal and economic doctrines.

Therefore, there are four main types of corporate governance, i.e. Anglo-Saxon, Germanic, Latin and Japanese.

We describe them below. It is particularly important when a Polish company transacts business with foreign entities.

|

Type of economic system |

Corporate governance models |

|||

|

Governance type |

Anglo-Saxon |

German |

Latin |

Japanese |

|

Countries |

USA, UK |

Germany, Switzerland, Austria |

Spain, France, Belgium, Italy |

Japan |

|

Company role |

Maximising shareholders’ benefits |

Company as independent institution |

Company as independent institution |

Company as independent institution |

|

Executive structure |

One-tier (board of directors) |

Two-tier (management board and supervisory board) |

Optional |

One-tier |

|

Major stakeholders |

Individual and institutional shareholders |

Banks, corporate groups, employees |

Financial and industry holdings, government, families |

Banks and other financial institutions, corporate groups, employees |

|

Correlation between remuneration and company performance |

Strong |

Medium |

Medium |

Low |

|

Source: J. Jeżak, Ład korporacyjny – doświadczenia światowe oraz kierunki rozwoju, Warsaw, 2010, p. 164. |

||||

![]()

Elements of corporate governance in a Polish company

In Polish companies, corporate governance is grounded in (i) the Commercial Companies Code, but its operation is also impacted by other legal provisions, including in particular (ii) the Accounting Act, (iii) the Public Offering Act and (iv) the MAR Regulation. However, many of these regulations are of dispositive nature which means that parties may agree on different rules.

In that way, another level of corporate governance is formed, i.e. articles of association. This is a company incorporation document in which shareholders establish specific rules to govern their relationship and secure their interests. However, based on the statutory provisions mentioned above, companies also adopt numerous supplementary rules and policies to clarify certain aspects.

We present a brief overview of these in the table.

|

Document |

Description |

|

Management board by-laws |

Governs the organisational, procedural and governance standards related to the functioning of the management board in a company. |

|

Supervisory board by-laws |

Describes procedural aspects related to the activities of the supervisory board. |

|

General meeting rules of procedure |

Governs the rules and procedure for the convening and holding of the general meeting. |

|

Remuneration policy |

Describes the components, criteria and methods used to determine the fixed and variable remuneration of members of the corporate bodies. |

|

Communication policy |

Sets out the rules for the company’s communication with capital market participants. |

|

Code of ethics |

Softly specifies the company’s mission and guiding values. |

|

Code of conduct for suppliers |

Specifies what actions and values the company expects from suppliers. |

|

Anti-corruption policy |

Describes the actions the company takes to combat, identify and disclose corruption. |

|

Whistleblowing policy |

Specifies ways to protect whistleblowers in the company. |

|

Animal welfare/environmental policy |

Demonstrates how the company approaches the protection of animals and the environment in relevant cases. |

|

Conflict of interest policy |

Specifies rules for the disclosure, avoidance and prevention of conflicts of interest in the company. |

Corporate governance on the WSE and NewConnect

Corporate governance is particularly important in the context of companies whose shares are publicly traded. Stock exchanges, responding to investors’ interest, often introduce so-called sets of best practice principles.

These usually operate in such a way that a listed company must either comply with the stock exchange principles or explain why it does not (comply or explain). By imposing such soft requirements on companies, stock exchanges effectively contribute to the incorporation of the principles from the set of best practices into companies’ corporate regulations as it can often be troublesome to explain to investors why the company does not comply with certain corporate governance requirements1. Additionally, investors are often willing to pay extra for the value of a company that complies with corporate governance principles.

Therefore, Giełda Papierów Wartościowych S.A. w Warszawie (Warsaw Stock Exchange) has incorporated two sets of corporate governance principles in the Stock Exchange Rules:

-

Best Practices for WSE-listed Companies 2021: corporate governance principles for joint-stock companies that issue shares, convertible bonds or senior bonds that are admitted to trading on a regulated market operated by the Warsaw Stock Exchange; and

-

Best Practices for NewConnect-listed Companies: corporate governance principles for issuers of shares admitted to the alternative trading system on the NewConnect market.

The above sets of principles are designed to ensure that Polish companies take into account the expectations of shareholders and address the needs of stakeholders, as well as consider ESG issues. Both sets of principles operate on the basis of the said comply or explain principle. The scope of the principles addressed to companies admitted to the regulated market is obviously broader than that addressed to companies introduced to the alternative trading system.

In the table below, we present examples of provisions in each area that indicate what corporate governance objectives the Warsaw Stock Exchange is trying to achieve.

|

Area |

WSE |

NewConnect |

|

Information policy and communication with investors |

A company efficiently communicates with capital market participants. To this end, it uses various tools and forms of communication, including, above all, the corporate website. The information disclosed also covers ESG issues. |

A company posts on its website in an easily readable form and in a separate location, and promptly updates (…) a brief description of its business model and the business strategy, including the ESG areas covered by the strategy. |

|

Management board and supervisory board |

A company should have in place a diversity policy for the management board and the supervisory board. The diversity policy sets out the objectives and criteria for diversity in areas such as gender, education, age and work experience. |

The scope of the professional activities of the members of the management board or the supervisory board should ensure that the company is managed efficiently and effectively and that effective supervision is exercised over the achievement of strategic objectives and results achieved. |

|

Internal systems and functions |

A listed company maintains effective internal control, risk management and compliance systems, as well as an effective internal audit function, adequate to the size of the company and the nature and scale of its operations, for which the management board is responsible. |

A company ensures solutions for internal control, risk management, including the risks relating to the preparation of financial statements, and compliance, as well as an internal audit function. |

|

General meeting and relationships with shareholders |

The supervisory board gives its opinion on the draft resolutions submitted by the management board to the agenda of the general meeting. |

The supervisory board reviews the agenda for the general meeting and gives its opinion on the materials to be presented by the company to the general meeting. |

|

Conflict of interest and transactions with related parties |

A member of the management board or the supervisory board informs the management board or the supervisory board, as the case may be, that a conflict of interest has arisen or may arise, and does not participate in the consideration of a matter in which a conflict of interest may arise in relation to him or her. |

No shareholder should be privileged over other shareholders with regard to the company’s transactions with shareholders or their related parties. |

|

Remuneration |

The remuneration of supervisory board members should not depend on the short-term performance of the company. |

No relevant provisions. |

1Hard regulations are often created in the wake of soft regulations. For example, this is what happened with the audit committee, audit firm rotations, corporate website, remuneration policy, related-party transactions, management board’s disclosure obligations and supervisory board’s report.

![]()

Corporate governance reporting obligations under the CSRD2

The CSRD, which should be implemented into Polish law by 6 July 2024, also introduces changes regarding corporate governance reporting.

It will be mandatory to report on governance issues in a special section of the management board’s report within the so-called sustainability statement (in XHTML format).

Under the CSRD, the European Commission issued ESRS3, a delegated regulation to the Directive, which within topical standards provides for one standard focusing on conduct of business, to be read together with the cross-cutting standards ESRS 1 and 2. This topical standard is called ESRS G1

Commission Delegated Regulation (EU) 2023/2772 of 31 July 2023 supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards (OJ EU. L. 2023, item 2772).

ESRS G1 aims to specify disclosure requirements that will enable the addressees of sustainability statements to understand the entity’s strategy and approach, processes and procedures, and its performance in relation to conducting business operations.

ESRS G1 aims to specify disclosure requirements that will enable the addressees of sustainability statements to understand the entity’s strategy and approach, processes and procedures, and its performance in relation to conducting business operations.

The standard focuses on the following issues:

- business ethics and corporate culture, including anti-corruption and anti-bribery policies, protection of whistleblowers and animal welfare

- management and quality of relationships with suppliers, including payment practices

- activities and obligations of the undertaking relating to the exercise of political influence, including lobbying

|

ESRS |

Brief description of the public disclosure requirement |

|

G1-1 |

|

|

G1-2 |

|

|

G1-3 |

|

|

G1-4 |

|

|

G1-5 |

|

|

G1-6 |

|

2 Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU as regards corporate sustainability reporting (OJ EU. L. 2022, No. 322, p. 15).

3 Commission Delegated Regulation (EU) 2023/2772 of 31 July 2023 supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards.

![]()

What’s next for corporate governance?

Polish companies are currently preparing for the implementation of the CSRD and the ESRS into the Polish legal system, with the deadline for implementation set for 6 July 2024. By that date, the Polish legislature should ultimately lay down the framework for non-financial reporting, including corporate governance. However, already at this point it is evident that it will be mandatory for Polish companies4 to review what policies they have in place, whether they are up to date and whether any real action has been taken based on them. The areas that Polish companies need to put particular focus on include: (i) corporate culture, (ii) prevention of corruption and bribery, (iii) supplier relationship management, (iv) political influence and (v) information on payment practices.

Both Polish and European legislation prioritise the support of weaker stakeholders in companies. Therefore, the current regulations of the WSE 2021, NewConnect 2024 and the CSRD and ESRS seek to increase transparency in governance, reduce links to dominant shareholders, and introduce disclosure obligations regarding policies related to suppliers, payment terms and anti-corruption.

The ultimate goal is to strengthen the protection of the interests of weaker stakeholders. It is worth observing this trend and preparing in advance for the regulatory requirements and changing market expectations.

Legal status as of 17 April 2024

4 The types of companies subject to the reporting obligation, as well as the period from which reporting should begin, are described in detail in our third ESG Newsletter under section “Who and when must report ESG impacts?”.

Kontakt:

dr Marcin Chomiuk – Attorney-at-law, Partner, Head of M&A, Corporate and Commercial Practice

Aleksander Eggink – Associate, Transactions M&A and Corporate Law, Contracts (Commercial)

Newsletter ESG:

II. ESG legal framework – where to find answersć odpowiedzi

III. ESG reportingin a nutshell. All the reporting undertaking needs to know and more